In this post, we’ll be exploring digital assets to see how they stack up to the rate of debasement. Remember that currency debasement has been taking place in the modern world through rampant central bank money creation. The key question for investors remains: are you outpacing this rate and by how much? In an era of rising costs due to currency losing its purchasing power, we want to increase our purchasing power to such a level that it leads to financial freedom? By the end of this post, you’ll learn whether or not digital assets increase our odds of achieving this financial freedom.

We’ll start out by exploring how digital assets like Bitcoin and Ethereum have performed versus stock indices and all other asset classes over the past decade.

The Performance of Digital Assets Compared to Stock Indices

We learned earlier how much better a $100 investment in stocks has performed versus other assets like bonds and real estate. How about Bitcoin? Bitcoin is the greatest performing asset in history and it’s not even close. Using the historical BLX chart on TradingView and taking the $.056 price of Bitcoin in 2010 to the $50,000 price in 2021, Bitcoin returned a comical 88,356,184%. That’s an 88 million percent increase.

Of course, very few of us were fortunate enough to even hear about Bitcoin until recently, let alone invest in it that far back. The end of 2015 and into 2016 was the first time that Bitcoin started appearing in the news and mainstream media. Therefore, let’s focus on how the price of Bitcoin performed from December 2015 to December 2021.

From a price of approximately $415 toward the end of 2015 to a price of $47,000 toward the end of 2021, that’s roughly a 12,000% gain for Bitcoin. How about the second largest digital asset, Ethereum? Using TradingView and the symbol ETH/USD on Bitstamp, we find that Ethereum gained 452,000% over the same time frame. In comparison, one of the major stock indices, the S&P 500, gained about 128% during this same six-year period.

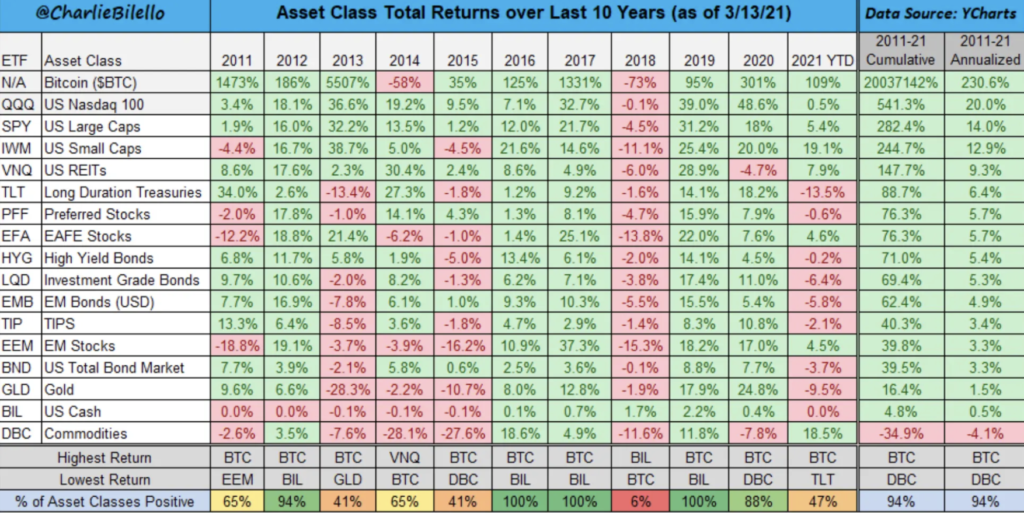

Charlie Bilello, Founder and CEO of Compound Capital Advisors, put together a beautiful chart to show the total returns of various asset classes over the last 10 years.

Ok, so clearly assets like Bitcoin and Ethereum have performed exceedingly well in the past decade, greatly outperforming every other asset class. But you might be wondering, is it too late? Have I already missed out? Let’s examine why digital assets are just getting started.

Why We Need Decentralization: History’s Fight against Over-Centralization

What makes decentralized crypto assets valuable in the first place? What’s the thesis for why Bitcoin and digital assets are just getting started and will rise to new all-time highs in future years? To answer that question, we need to understand the value that decentralized assets bring to the world.

Centralization itself is not necessarily a bad thing, but over-centralization that leads to tyranny, corruption, and too much power in the hands of one individual or entity is dangerous and needs to be protected against. Since the beginning of time, humans have fought against oppression in the name of individual liberties whenever over-centralization has reached extreme levels.

One of the earliest examples of fighting against over-centralization came in 1215 with the signing of the Magna Carta. Rising up against the oppressive ruler, King John, this extremely significant document protected citizens from unjust over-taxation, limited the power of the monarch, and established the idea that all people and institutions are subject to and should be held accountable by laws. The American Revolution was an uprising against over-centralization as British rule under King George III taxed the 13 American colonies without their consent. This led to the Declaration of Independence and eventually to one of the most significant pieces of legislation, the Constitution of United States. The Constitution divided power among three branches and established a system of checks and balances to ensure individual liberties and freedom. The battle for human rights and the fight against over-centralization has continued to be a key fundamental aspect of human evolution.

Bitcoin was invented as a direct result of the 2008 financial collapse, which was caused by human fallacy and greed, and ultimately over-centralization. The distributed network technology behind Bitcoin and other public blockchains is revolutionary for decentralization as it removes the need for intermediaries. Companies with a single point of failure like Equifax are exactly why decentralization is so valuable. In one of history’s largest data breaches, hundreds of millions of Americans had their personal data stolen. Public blockchains contain methods of self-governance that are free from human error and corruption. We can use this groundbreaking technology to truly decentralize the next wave of innovation in finance, arts, music, IoT (internet of things), and much more.

In an era when nations are getting ready to issue CBDCs (Central Bank Digital Currencies pegged to the value of that country’s currency) that will further erode the economic and personal freedoms of citizens across the world, decentralized digital assets have never been more important and relevant.

Still so Much Room to Grow

The Visual Capitalist, one of the internet’s best sources for interesting infographics, created a chart showing all the world’s money and markets. I didn’t include it in this post because it’s an insanely large graphic and it’s also over two years old now, so some of the data is a bit outdated. But it’s still incredibly powerful in helping us understand just how nascent the crypto market is and how much growth we can expect in the coming years. You can check it out at <https://www.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization-2020/>, but I’ll highlight just a few of the chart’s jaw-dropping elements.

At the time of writing this post, the entire market cap of digital assets is $1.1 trillion. The global real estate market is worth $320 trillion. The total United States stock market is valued at $43 trillion. The market cap of gold is $11.5 trillion. And perhaps most amazing, the balance sheet of the Federal Reserve (assets under ownership) is $8.8 trillion. Crypto is like a small minnow swimming in the vast ocean of the world’s money. In an era that consists of rampant money creation to prevent economic disaster, $1.1 trillion is infinitesimally small.

In the next post, we’ll go over some of the most common misconceptions or hesitations that investors have about digital assets. It’s vitally important to see this new asset class through the correct lens.

Thanks for reading! If you enjoyed this, check out the other articles and don’t forget to follow me on Twitter @andrewdfarrar for up-to-date crypto content. If you haven’t already checked it out, my book, The Modern Investor, is up for sale on Amazon! It gives a much more complete and entertaining view into the digital asset market. In these crazy times, it’s never been a more important time to learn about this new asset class.