In this article, we’ll explore the key concept of currency debasement and why it has such an impact on our lives. By the end of this post, you’ll understand both the most significant obstacle to financial freedom and the big picture game we’ve all been forced to play.

Debasing a currency has been happening as far back as the Roman Empire and used to mean devaluing the currency by lessening the amount of precious metals in the actual coinage. In modern times, currency debasement has been taking place over decades of rampant central bank money printing. They can now do this electronically by buying treasury securities and simply crediting the accounts of the receiver banks with the newly created money.

The Ballooning Money Supply

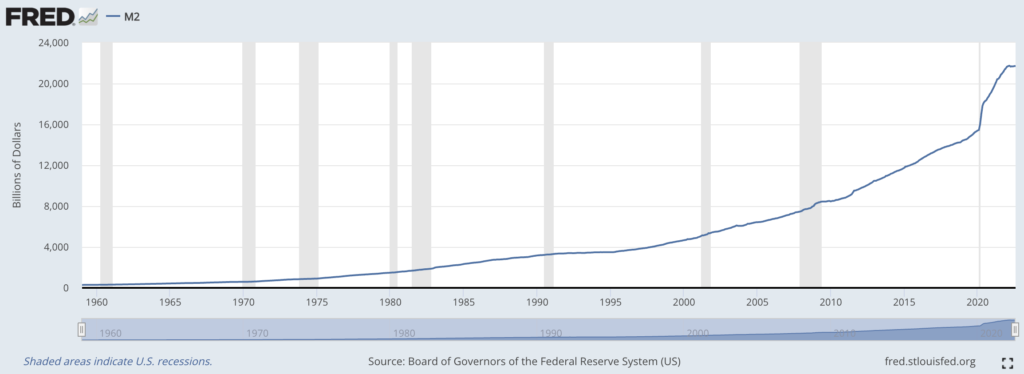

In the United States, the money supply is most often referred to as M2, which is a measure of cash and checking deposits (M1) plus near money. Near money consists of savings deposits, money market securities, and other time deposits. The more the M2 supply increases, the more the purchasing power of the dollar declines.

There was a total of $15.4 trillion in M2 at the start of 2020. By December 2020, that figure had shockingly grown to $19.12 trillion. That means that in 2020, 19.5% ($3.72 trillion out of $19.12 trillion) of all M2 ever in existence was created.1 Here’s a shocking visual showing this explosion in new money.

Chart of M2 Money Supply

Not surprisingly, with the unprecedented new money created in 2020 and 2021, inflation really began to get out of control at the end of 2021.

Today’s Inflation Problem; The Fed Fumbled Fantastically

Despite many economists and the general public voicing concern over future high inflation , Fed Chairman Jerome Powell and other financial heads, like Secretary of Treasury Janet Yellen, insisted throughout 2021 and most of this year that inflation would not be an issue, and that keeping it around the 2-2.5% target would be achievable.

Unfortunately, they were very wrong, and the numbers ballooned to such an extent that the most recent CPI (consumer price index) release revealed that inflation hit a staggering rate of 9.1% in the United States as of June 2022.2

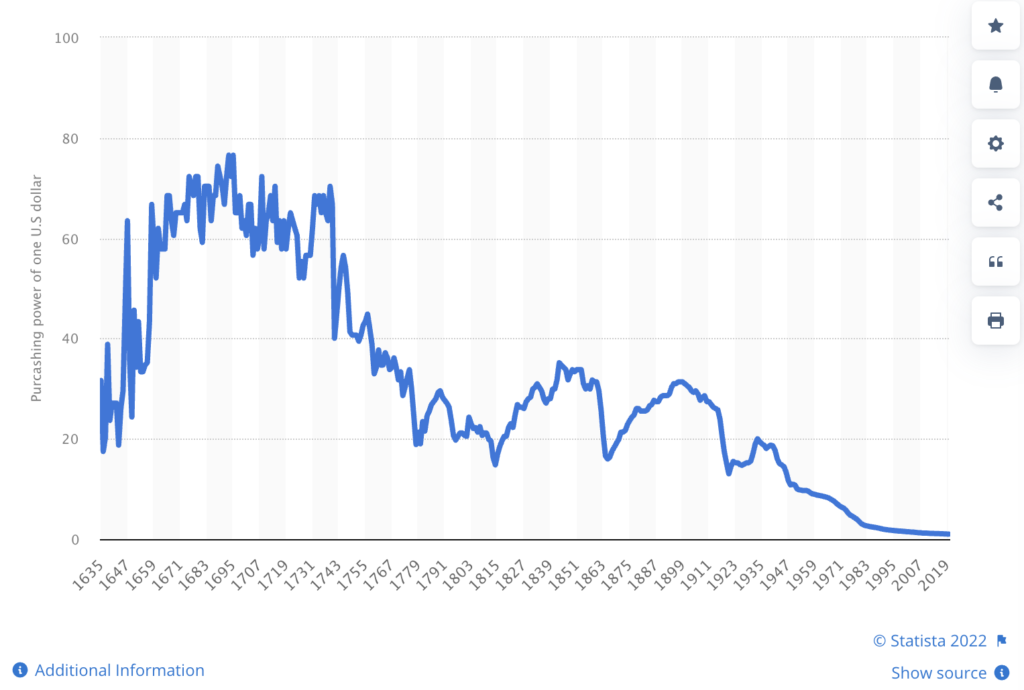

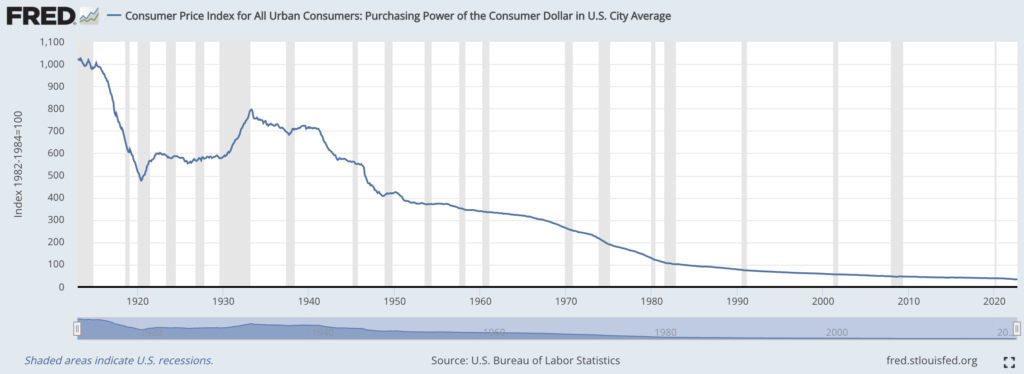

This rampant money creation is not a recent phenomenon either. The following three charts show the result of this consistent money printing.

The Purchasing Power of One US Dollar since 1635

The Purchasing Power of the Consumer Dollar in US City Average

As you can see, the value of the US dollar has been nosediving at a rate that makes torpedo dives look like child’s play. Everything is far more “expensive” today than it used to be. If you bought an item for fifty dollars in 1913, how much do you think it would cost today? Five hundred? Eight hundred? Nope. That same item would cost you $1,495.81 today. That’s a cumulative inflation rate of 2,891.63%!3

“Printing money is merely taxation in another form. Rather than robbing citizens of their money, the government robs their money of its purchasing power.”4

-Peter Schiff

The sad reality for the rest of the world is that the US dollar has held its value extremely well compared to other countries. That’s strictly because of the dollar’s status as the global reserve currency. So, what does this mean to us as investors?

The Name of the Game

With this trend of the dollar losing purchasing power, the only question that really matters is this: are you outpacing the rate of debasement and by how much? There are only a handful of ways to outpace debasement: win the lottery, build a business like Amazon, inherit millions from a distant aunt, or invest in assets that can grow exponentially over the years.

Since we probably have a better chance of being struck by an asteroid tomorrow morning than any of the first three options, owning assets is the most realistic and promising avenue to financial freedom.

In the next post, we’ll explore how crypto stacks up to all other asset classes. We’ll learn why we need decentralized assets and why they’re so valuable.

Thanks for reading! If you enjoyed this, check out the other articles and don’t forget to follow me on Twitter @andrewdfarrar for up-to-date crypto content. If you haven’t already checked it out, my book, The Modern Investor, is up for sale on Amazon! It gives a much more complete and entertaining view into the digital asset market. In these crazy times, it’s never been a more important time to learn about this new asset class.